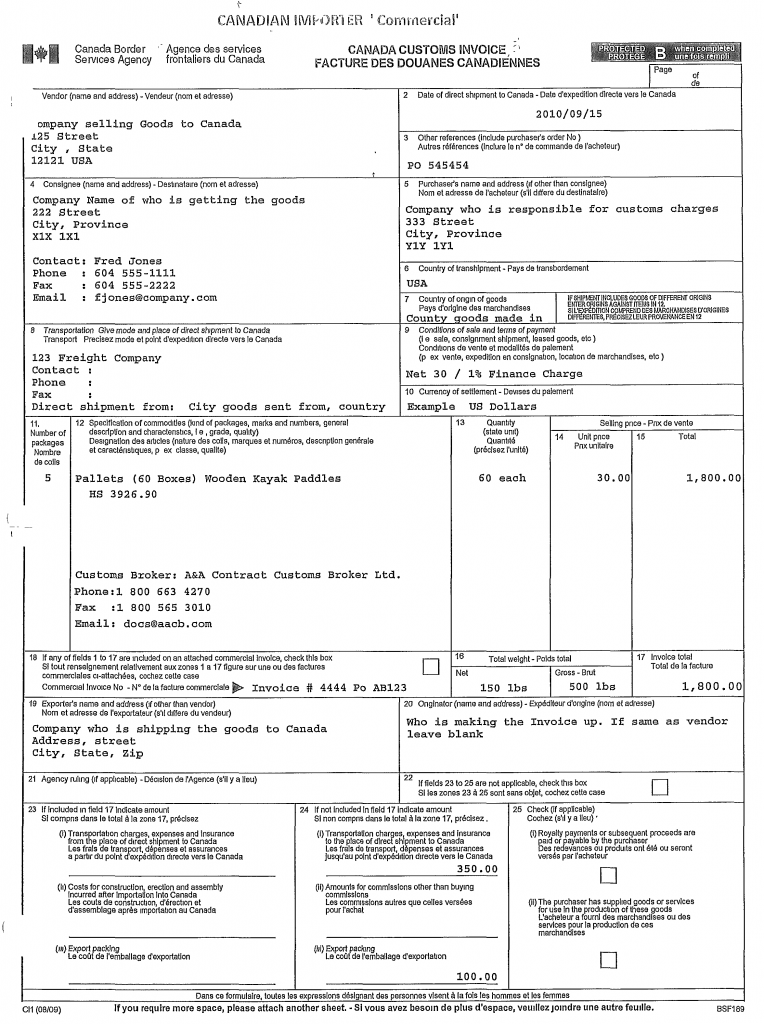

Commercial Invoice For Canada

Some extra time spent on your paperwork will contribute a great deal to problem-free customs clearance since inaccurate or incomplete documentation is the most common reason for. When the goods are ready to ship the seller issues a commercial invoice.

Canada Customs Invoice Coastline Express

Fees are paid by the receiver.

. Please note there are some exceptions to these requirements. Usually before issuing a commercial. Please fill in the invoice correctly and complete a not correct invoice might lead to delayment in.

Gifts that are valued at 39 or less approximately 65 Canadian Dollars are exempt from duties and taxes provided the following conditions are met. They need the commercial invoice to quickly decide what taxes tariffs or duties apply to the package and prevent any hold-ups. Canadian Commercial Invoice For the sole use of sending a package from.

The commercial invoice is the main document that is utilized for control of the import valuation classification and determination of duty by the countries customs agent. We designed our free invoice template to be compatible with nearly every spreadsheet program. Foreign buyers require this document in order to prove ownership and arrange for payment.

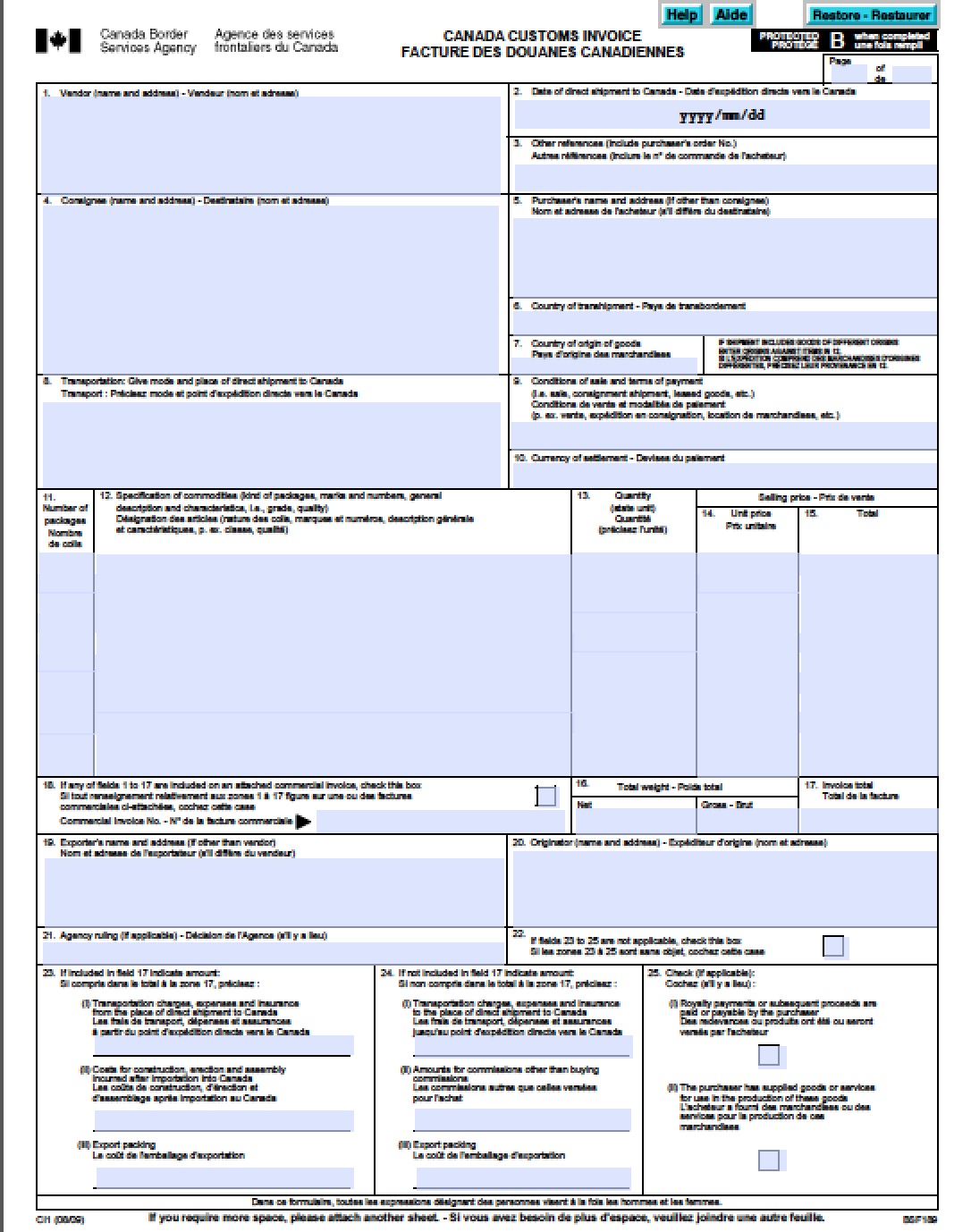

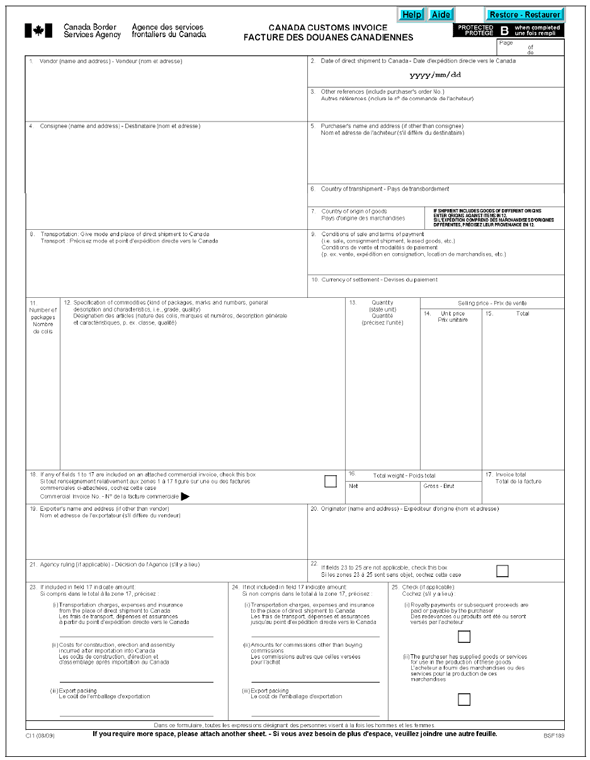

Can use a commercial invoice to indicate the value of the items. The form may be prepared by the supplier importer. A Canada Customs Invoice CCI or Commercial Invoice is required for every commercial entry into Canada.

All shipments to and from Canada must utilize a customs broker. Its the primary document used by most foreign customs agencies for import control valuation and duty determination. Download Commercial Invoice Template - Excel.

The document shows that the taxes and duties have been appropriately assessed before the continuation of the shipment. As well the document. Record the number of packages being shipped describe the goods enclosed and include a Harmonized System HS code to classify the goods if needed.

Canadian national holidays differ from the US. Once the buyer and the seller agree upon the terms of the sale and the buyer has accepted the terms of the proforma invoiceusually by submitting a purchase order that the seller has acceptedthe transaction is ready to proceed. Canada Customs requires certain information to be provided.

Businesses that export goods to locations outside of the US. If the International shipment youre sending is going to a country outside of the UK and contains items of a commercial value youll need to pr. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

The Commercial Invoice is required for all international commodity shipments and serves as the foundation for all other international shipping documents. This form is used to provide the necessary information to customs for all Canada-bound commercial goods. The commercial invoice should also identify any and all products being shipped and potential hazards.

Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell. Commercial shipments to Canada regardless of mode of transport which are valued at over 1600 Canadian funds are not classified under HTUSA Chapter 9810 and are subject to duties and sales taxes should be accompanied by a Canada Customs Invoice. Please print your invoice on your official company letterhead.

COMMERCIAL INVOICE EXPLAINED. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable ie invoices to a third party called a factor at a discount. Customs regulations are complex and often different from those used by Canada shipping goods across the border can be relatively uncomplicated if you are well prepared for it.

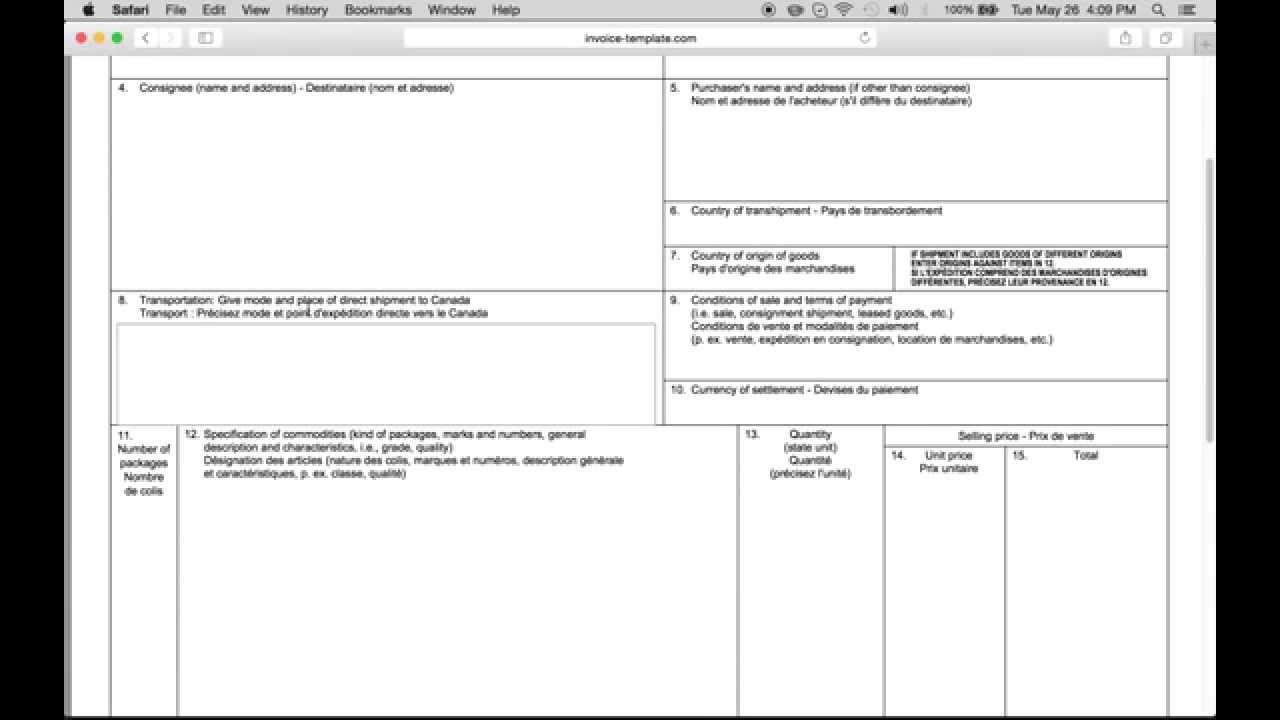

The invoice must contain all the information currently required by Canada Customs Regulations and can be prepared. It works with Google Spreadsheets OpenOffice and all versions of ExcelThe Service Invoice form for Google Sheets based on our original Excel invoice is one of the most popular templates in the entire Google Templates gallery. A DHL commercial invoice is a document prepared by an exporter that classifies the contents or merchandise of a shipment in order that customs can properly receive and clear the shipment.

This does not apply to private shippers. All shipments to and from Canada must utilize a. An export declaration is required by the Canada Border Services Agency CBSA to report commercial exports from Canada that are valued at CAD2000 or greater destined to any country other than the US Puerto Rico or the US.

Using a customs broker. Please indicate for each item in your shipment a detailed description if known a Export Harmonised Tariff Customs Code the quantity of the item the unit value without VAT. This special export document is required by customs the authority responsible for controlling imports.

The words Gift Shipment or Unsolicited Gift are included on the commercial invoice A detailed description of each item is provided. Updated May 31 2022. The Commercial Invoice.

A commercial invoice is a document that serves as a request for payment for goods sold internationally. Sections are also. For more information please visit the.

You need a Bill of Lading and a Canadian Commercial Invoice CCI Shipment value must be indicated on the Commercial Invoice.

Fill In Canadian Customs Invoice Template Form Ci1 Youtube

Free Canada Customs Commercial Invoice Template Form Ci1 Pdf Word Excel

Free Canadian Commercial Invoice Template Form Ci1 Pdf Eforms

Free International Commercial Invoice Templates Pdf Eforms

Memorandum D1 4 1 Cbsa Invoice Requirements

Canada Commercial Invoice Format Free Invoice Template For Mac Online Mac Is A System Made By Apple Invoice Template Invoice Format Invoice Format In Excel